Pay friends.

Pay for everything.

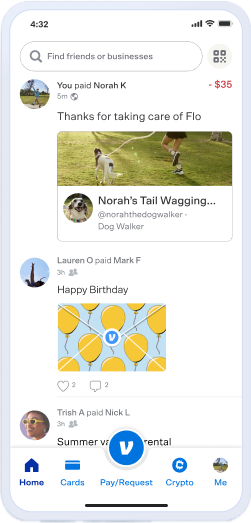

Easily send money to your friends

and pay for everything* you want online, in-store, and in apps with your Venmo account.

Learn more

*Purchase restrictions apply

Venmo everything, online and in-store.

The Venmo Debit Card.

With the Venmo Debit Card,1 you can instantly pay for whatever you want with the money in your Venmo balance and earn up to 15% cash back2 from some of your fave brands. There is no monthly fee or minimum balance.

Checkout with Venmo.

Connect your Venmo account to thousands of apps and websites and quickly check out using your Venmo balance3 or a linked payment method.

The Venmo Credit Card.

Earn up to 3% cash back on eligible purchases with the Venmo Visa® Credit Card.4 There’s no annual fee,5 no limit to the cash back you can earn, and no impact to your credit score if declined.6

Venmo your

friends

Venmo your friends

The Venmo app makes settling up with friends feel more... friendly. Send and receive money with Venmo friends to split everyday necessities, bills, and shared activities like takeout or travel.

Need a gift? Keep it simple and make any payment feel extra special with Venmo. To send a gift card,7 simply tap the Gift button and choose from top brands.

Grow a business.

Engage customers and take business payments with a seamless checkout experience people already know and trust.

Purchase crypto

Start your journey for only $1.8 Buy, track, transfer, and sell crypto through the Venmo app.9

Get the

Venmo App

1 The Venmo Mastercard® is issued by The Bancorp Bank, N.A., pursuant to license by Mastercard International Incorporated. Card may be used everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. The Bancorp Bank, N.A. is issuer of the Card only and not responsible for the associated accounts or other products, services, or offers from Venmo.

2 Venmo cash back terms apply. Offers are available for a limited time at select merchants. Max cash back applies and varies.

3 Ability to use money in your Venmo account to make purchases with authorized merchants is subject to Venmo verifying your identity. Learn more.

4 Earn 3% in the eligible top spend category, 2% in the second eligible top spend category, and 1% back on the rest, subject to the limitations and restrictions set forth in the Reward Program Terms. Use of cash back is subject to the terms of the Venmo User Agreement.

5 See Terms & Rates.

6 Subject to credit approval. You must be at least 18 years old and reside in the US or its territories to apply. You must have a Venmo account in good standing, that has been open for at least 30 days prior to application. An approved Venmo Credit Card application will result in a hard credit inquiry, which may impact your credit score.

The Venmo Visa® Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA is a registered trademark of Visa International Service Association and used under license.

7 Venmo account required. Eligibility requirements and terms apply.

8 When you buy or sell cryptocurrency, we will disclose an exchange rate and any fees you will be charged for that transaction. The exchange rate includes a spread that Venmo earns on each purchase and sale. Buying and selling cryptocurrency is subject to a number of risks and may result in significant losses. Please see our disclosure here for more details. Venmo does not make any recommendations regarding buying or selling cryptocurrency. Consider seeking advice from your financial and tax advisor. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider, Paxos Trust Company, LLC.

9 PayPal Balance or Venmo accounts required.

When you buy or sell cryptocurrency on PayPal or Venmo (including when you checkout with crypto on PayPal), Paypal or Venmo will disclose an exchange rate and any fees you will be charged for that transaction. For currencies other than PYUSD, the exchange rate includes a spread that is earned on each purchase and sale. Learn more about cryptocurrency fees on PayPal and Venmo.

Buying and selling cryptocurrency is subject to a number of risks and may result in significant losses. Please see PayPal’s disclosure and Venmo’s disclosure for more details.

PayPal and Venmo do not make any recommendations regarding buying and or selling cryptocurrency. Consider seeking advice from your financial and tax advisor. Some custody, trading, and transfer services for cryptocurrency are performed for PayPal and Venmo by our licensed service provider, Paxos Trust Company, LLC. PayPal USD is issued by Paxos, not PayPal or Venmo, and is subject to the Paxos US Dollar-Backed Stablecoin Terms and Conditions.

Any cryptocurrencies you hold in your Venmo account are not deposits, are not eligible for pass-through FDIC insurance and may lose value. FDIC insurance protects against the failure of a Program Bank, not the failure of PayPal, which provides the Venmo service. PayPal is not a bank, does not take deposits and is not FDIC insured.

Cryptocurrency activity is not a regulated activity in many U.S. states and territories. PayPal, Inc. is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Buying, selling, transferring, and holding cryptocurrency with PayPal and Venmo is not available in Hawaii and where prohibited by law.

All cryptocurrency prices shown are for illustrative purposes only.

All trademarks and brand names belong to their respective owners. Use of these trademarks and brand names do not represent endorsement by or association with this card program. All rights reserved. Standard data rates from your wireless service provider may apply.